|

BFSA - BUSINESS PLAN 2015-2017 Belgian Food Safety Agency |

| FR | NL | DE | EN |

|

|

| The BFSA as an organization |

Social, economic and administrative context | Stakeholders vision | Strategic and operational objectives 2015-2017 |

Inspection frequencies | State of affairs of the objectives |

|

Socio-economic context Consumers and food safety Consumer concerns over product safety are a major motivating force when the BFSA carries out its tasks. It must also take into account changes in an ageing population, fragmented into smaller, more diversified, more mobile and more connected units. The percentage of people’s expenditure on food has remained relatively stable between 2010 and 2012, following a phase during which it fell sharply (-31.1 % between 1978 and 2010 – source: SPF Economie). Consumer habits within this population are also constantly evolving. In terms of consumption, we note a decrease in the quantity of meat and fats, offset by a rise in the consumption of fruit, vegetables and fish, with growing interest in ecological production, especially in the farm products sectors. Although it is reassuring to see that consumers feel increasingly concerned by food safety – particularly with regard to hygiene, bacterial contamination and pesticide residues – a survey conducted in 2013 clearly shows that little or nothing is known about the BFSA and its activities. The BFSA will have to take all these factors into account for the future development of its activities. Agricultural suppliers 1. Animal Feed During recent years, the animal feed sector – represented by the Belgian Compound Feed Industry Association (BEMEFA/APFACA) – has pursued its efforts towards sustainability, which are in constant conflict with the quest for profitability. BEMEFA/APFACA has been involved from the outset in setting up the Centre of Expertise on Antimicrobial Consumption and Resistance in Animals (AMCRA) and assumes its responsibilities for combating antimicrobial resistance. The target is to reduce the use of medicated feed by 50%. Over the coming years, the sector intends to continue with these efforts, largely by reinforcing synergies with other stakeholders. It will have to take into account the pressure exerted by falling consumer prices for products of animal origin, which is affecting suppliers. Finally, everything possible will be done to strengthen the position of Belgium as an exporter, mainly through closer collaboration between private enterprise and the administration. 2. Oils and fats sector Following a period where the public authorities applied real pressure on the sector to produce biofuels, it now seems that this trend has come under threat. This could seriously imperil the profitability of the sector. Moreover, because it is lagging behind in terms of GMO permits, Europe could cut itself off from important sources of vegetable oils and fats. These two factors will no doubt need to be monitored closely in the years to come. 3. Plant protection products The use of plant protection products and their potential impact on health and the environment remains a source of grave concern for the general public. Faced with this situation and the need to respond to demand from a growing population, professionals in the sector plan to take a new approach that combines innovation, competitiveness and sustainability, based on a scientific assessment of the risks and benefits. The plant protection industry intends to take into account societal concerns by promoting better practices and working in concert with all stakeholders: health, biodiversity, sustainability and food safety. Primary Production In the agricultural sector certain past trends continue:

From an economic standpoint, the share of agriculture in GDP has continued to decline, to 0.6% in 2013 (1.13% in 1980), but this figure must be seen in the context of growth in the agri-food sector. In addition, the share of agriculture in Belgian exports remains relatively high (5.7% in 2013). In the future, the new CAP (common agricultural policy) 2014–2020, some elements of which have only been in force since 2015, will affect the profitability and structure of the primary sector. Various aspects, such as the percentage of ecologically significant areas to be respected, as well as the different forms of coupling premiums with production (suckler cow premiums, mixed herd premiums, premiums for sheep and goats) are going to redefine the agricultural landscape. As for export, in addition to the Russian embargo on pig meat for health reasons since early 2014, there has been an economic embargo since July 2014 on a wide range of agri-food products, which will also affect the profitability of farms and industries. It will therefore be more than ever necessary, in partnership with the sectors concerned, to develop agreements giving access to new markets. In parallel, the risks associated with invasive species and emerging diseases need to be taken into consideration and have an impact on import controls. Free trade treaties under negotiation will also influence agriculture and international trade. For certain products this may mean new outlets, but others may be negatively affected by the differential requirements in terms of animal welfare, health standards and the use of substances banned in Europe; Belgium must without doubt remain vigilant. Finally, the growing importance of short supply circuits needs to be taken into account by the BFSA in its quest for an acceptable balance between food safety and flexibility. Food Industry The food industry – represented by FEVIA – carries considerable weight in the Belgian economy. This sector has resisted the financial crisis well. It represents a total of 226,000 direct and indirect jobs and turnover of €48.2 billion in 2013, up by 1.5% (Source: FEVIA). The food industry is a diversified and ambitious sector, committed for many years to a safe, reliable and transparent food chain, partly through its efforts to increase the number of validated self-checking systems in establishments in partnership with the BFSA. This sector is constantly on the lookout for innovation and sustainability, and has the export market resolutely in its sights. This latter aspect is of course of particular importance today, against a background of international political tensions that could have a direct impact on our exports, as the recent embargo imposed by the Russian authorities has proven to be. With Food2015, the food industry has set itself an ambitious growth target of 6 billion euros for 2015. The Food.be promotion platform has been launched with the slogan “Small country. Great food”. This slogan perfectly reflects what Belgian food represents: quality, diversity and innovation. FEVIA promotes a healthy lifestyle with balanced nutrition and regular physical activity. With an extremely varied output of foodstuffs, the food industry plans to offer consumers choice with a view to balanced nutrition. Innovation in the food sector will enable it to respond better to consumer needs and expectations, in particular in terms of nutrition. The two centres of competitiveness (WagrALIM and Flanders’ FOOD) provide scientific support for improving the nutritional value of products. Meat Despite the decline in meat consumption in Belgium (86.5 kg per inhabitant in 2013 compared with 101.4 in 2004), the meat sector continues to be of primary importance (€6 billion in turnover in 2012), and has a solid positive trade balance (almost €2 billion in 2012). The leading export markets in Europe are France, Germany and the Netherlands. The meat sector, in particular the pork sector, has been severely affected by the embargo imposed by the Russian authorities in January 2014. Fruit and vegetables The fruit and vegetable sector is another heavyweight, especially in terms of export. Export represented €4.1 billion in 2012, mainly destined for France, the Netherlands, Germany and the United Kingdom. As for third countries, the main outlets for processed potato products are Brazil, Saudi Arabia and Chile, while the United States provides an important market for frozen vegetables (25% of European production of frozen vegetables comes from Belgium). Belgium is one of the world leaders in the potato industry. It is the world leader for export of potatobased products and the world’s biggest importer of fresh potatoes. This gives an idea of the scale of the processing industry in this sector. This sector was also affected by the embargo imposed by Russia. Milk and dairy products With a turnover of €4.4 billion in 2012 and exports worth €2.6 billion, the dairy sector is also a major food industry player. More than half of such exports are destined for France, the Netherlands and Germany. Exports to third countries represent 16.6%. Exports of drinking milk have seen exceptional growth in recent years. The approval of 20 Belgian dairy companies in 2014 for the exportation of milk and dairy products to China is a very important achievement given the potential of this market. We can therefore expect to see continuing growth in exports of Belgian milk and dairy products to China over the coming years. Other sectors Other important sub-sectors are chocolate (€2.5 billion in exports in 2012, with more than 20% to third countries) and beer (€1.1 billion in exports, more than 70% of which went to France, the Netherlands and the United States), as well as water and other drinks. Distribution In addition to significant price fluctuations, the distribution sector has had to adapt to a major modification to commercial structures. Since 2000 we have seen a drastic decline in the number of independent FFBO’s (36% of butchers, 30% of fishmongers and 19.5% of grocers have disappeared), partially offset by a spectacular increase in small supermarkets (+ 64% over the same period). Although sales surfaces have reduced slightly in urban centres, they have increased very significantly on the outside of towns with the installation of hypermarkets. Consumers are now making greater use of the internet for online purchases, as well as for price comparisons that put the sector under constant competitive pressure. We are seeing a constant rise in the market share of hard discounters in all sectors, and in particular for fresh meat. Faced with this situation and the consumer concerns already mentioned, the distribution sector has come up with the following: People’s expectations:

Economic constraints:

Socio-cultural expectations:

Sustainability requirements:

Technological challenges:

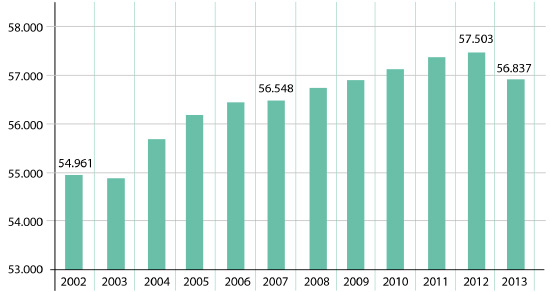

In conclusion, it appears that today the distribution sector must better satisfy socio-cultural and sustainability expectations, as well as adapting to economic trends: consumers are often prepared to pay more for products that meet their expectations. Products must also adapt to consumers that are moving increasingly towards vegetable consumption, increasingly connected and keen to support local trade where it offers a wide range. Catering The catering sector counted 56,837 FFBO’s in 2013. This figure shows a slight decline in the number of catering enterprises compared to 2012. See the graph below: Number of catering enterprises in Belgium  In parallel, given the economic situation, the sector has seen a large number of bankruptcies. The sector also has a very large number and a wide variety of workers, as well as a high rate of staff turnover. This is no doubt a feature that should inform the BFSA mission, especially in terms of training workers to comply with good hygiene practices and sanitary standards. The sector is investing heavily to meet the rising demand. Current trends are towards faster service and more take-away products using vending machines. The sector also plans to develop innovative ranges (cross-business, street food and bistronomy concepts). The sector will also pursue its efforts in the field of healthy economic management. |

|